Rebalance & Diversify: Staying Strategic in an Evolving Market Environment

The U.S. economy is currently experiencing steady growth, with a year-over-year expansion of 2.7%,[1] aligning with historical trends. Key factors driving this growth include capital accumulation, labor input expansion, and technological progress, particularly in areas like artificial intelligence (AI), data centers, and renewable energy. Notably, U.S. productivity has exceeded historical norms, with output per hour rising over 2%, a significant improvement over the 1.5% annual growth seen between 2007 and 2019.[2]

U.S. core inflation is now nearing the Fed’s 2% target. However, inflation expectations remain above target, with the University of Michigan [3] forecasting a 3.1% average inflation rate over the next five years. Although unemployment remains low, job growth is slowing, and fewer job openings align with the Fed’s strategy of rate cuts to support the labor market.

Corporate America is performing well, with 77% of S&P 500 companies surpassing earnings expectations in the third quarter. This positive performance has provided further evidence of the “Goldilocks” scenario, where inflation slows while economic growth remains solid. Interest rate cuts have led to a normalization of the Treasury yield curve, with long-term rates rising and short-term rates falling, signaling an expanding economy.

Fixed-income markets have performed well this year, with lower-credit-quality bonds offering higher returns as investors search for income. Credit spreads for both investment-grade and high-yield bonds are below their historical averages, and while further tightening may be limited, municipal bonds have become more attractive as their yield curve has shifted upward.

U.S. stock markets have outperformed international markets in 2024, with large-cap stocks leading the way. Within the S&P 500, the Information Technology and Communication Services sectors, including the “Magnificent Seven” tech giants, have posted impressive returns. However, the concentration in a small group of companies— with the top 10 stocks contributing to 58% of the S&P 500’s return—raises concerns about the representativeness of passive investing strategies, which may not fully reflect the broader U.S. economy.

Earnings growth for the “Magnificent Seven” is expected to slow, with the broader market likely to catch up. The current P/E ratio for the S&P 500 is 35% above its 20-year average, and projected earnings growth of 15% over the next year could present challenges for equity returns, particularly among top-performing stocks.[4] U.S. companies’ earnings growth is still outperforming their non-U.S. counterparts.

Alternative investments, including private markets, have lagged due to high interest rates and a weak exit environment. Still, their core benefits remain intact, such as uncorrelated returns and protection against drawdowns. Liquid alternatives can also play a similar role in diversifying portfolios.

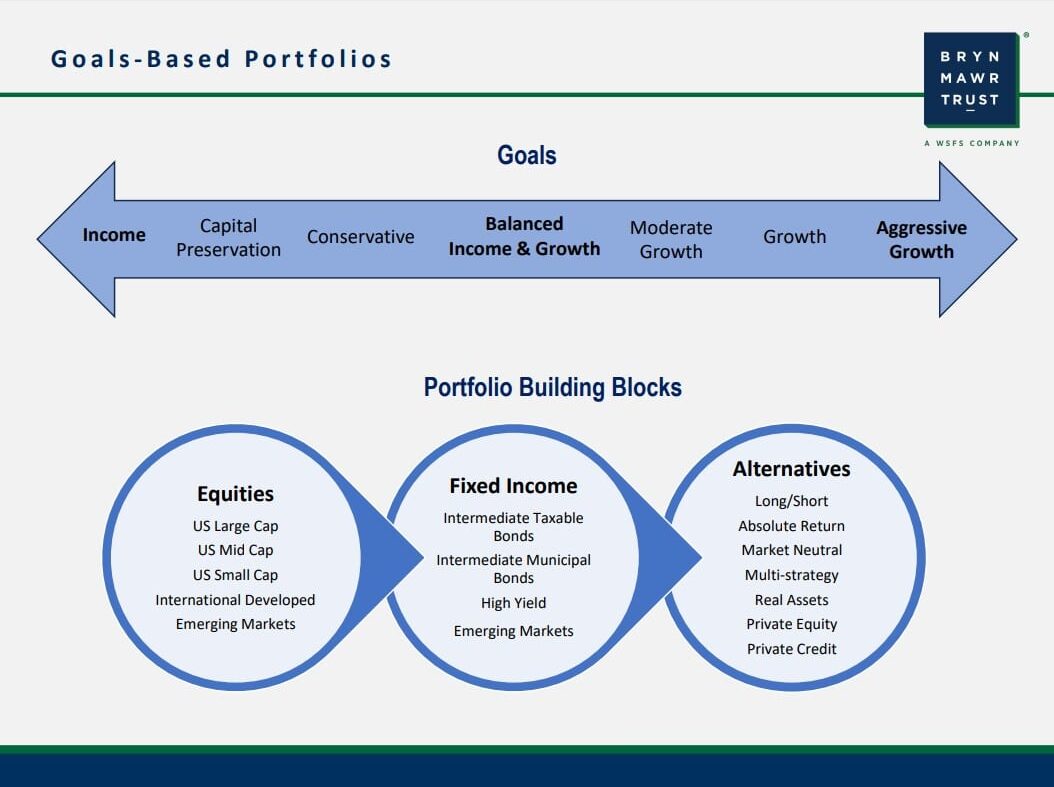

We maintain a neutral stance on stocks, bonds, and alternatives, with slight tilts toward U.S. equities, mid and small-cap stocks, and high-quality bonds. Recent adjustments to our alternative allocation reflect a more cautious risk management stance after two years of strong equity market performance.

The U.S. economy faces several risks and opportunities related to President-elect Donald Trump’s policies when looking ahead. His proposed changes, including tax cuts, deregulation, and a tough stance on immigration and trade, could push inflation higher, raise bond yields, and strengthen the U.S. dollar. However, his policies may result in economic volatility, including increasing the national debt and potential challenges to fiscal sustainability.

Overall, our base case envisions a soft landing for the economy through 2025, with a steady but slowing economy and continued declines in inflation. Recessionary risk and overheating concerns remain.

At year-end, we recommend rebalancing portfolios back to strategic asset allocations and maintaining a diversified, flexible approach to navigate the evolving economic and market environment.

[1] WSJ, The Next President Inherits a Remarkable Economy – WSJ

[2],[3] Surveys of Consumers, University of Michigan,fetchdoc.php, October 25, 2024

[4] FactSet as of October 2024

Begin your journey

Have questions?

Speak with an financial expert.