2024 Mid-Year Market Outlook: What Lies Ahead

The U.S. economy continues to grind, and macro-level data suggests that moderating growth ahead will not cause a near-term recession. When setting the current environment at a level compared to our expectations at the start of the year, investors witnessed more mid-cycle dynamics as risks to the downside lessened and valuations expanded. With the macro-economic environment seemingly in a constructive place, we’re reminded that complacency is not a viable investment strategy. In our mid-year update, we detail the opportunities and risks ahead.

In summary, from a top-down perspective, the U.S. economy remained in expansionary mode during the first six months of the year, and leading indicators point to continued strength going forward. Inflation, while still elevated in areas like commodities and wages, remains at levels that do not appear to put the economy at risk. We continue to view a soft-landing scenario as most likely in the near term.

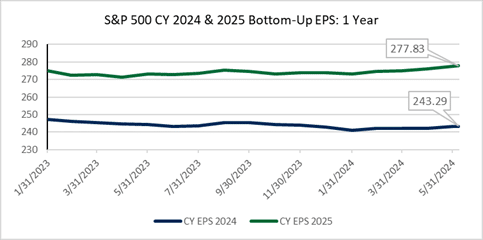

Equity-market valuations remain above historical averages, which we view with caution knowing that earnings growth will likely need to meet or exceed expectations for gains to materialize in the back half of the year. While a handful of companies tied to artificial intelligence continue to dominate investor mindshare and lead the indexes, we know from history that technology trends play out in stages. Early winners are often replaced or rendered less relevant as innovation unfolds. The current risk that a select few companies don’t continue to hit expectations is offset by the potentially powerful impact down the road as the technology finds a home in applications that enhance profitability.

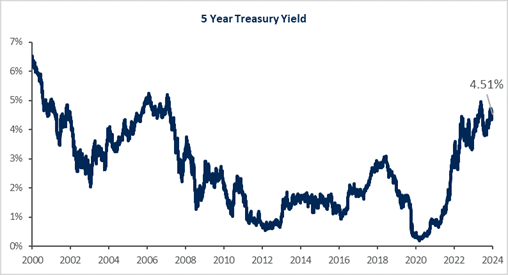

Fixed-income investors took their cues from equity results and the Fed’s decision to pause and watch the impact of its rate-hiking campaign. While bonds struggled early in the year, the outlook looks more promising. Yields have increased and expectations for rate cuts later this year and in early 2025 remain. Lower rates could also benefit segments of the markets that have lagged, mainly some emerging markets, small-caps, value stocks, and areas of real estate and private equity. Across the globe, central banks in developed countries are addressing a similar battle between inflation and growth.

While monetary policy has been restrained, on the fiscal side, government stimulus continues as an election cycle moves into high gear. We highlighted the political dynamics in our forecast at the beginning of the year. We also continue to monitor geopolitical risks, where tensions remain elevated, creating another source of potential uncertainty. Realizing that risks constantly shift, we outline our thinking about diversifying strategies in select alternative asset classes, which have the potential ability to add value within portfolios.

Our asset allocation position reflects the risks and opportunities we see ahead and our belief that diversification and consistent execution drive longer-term investment results and capital preservation despite changing economic landscapes. We are neutral in our position in equities versus fixed income. In equities, we have a modest overweight to domestic companies with an expectation that market leadership will broaden over time. We are biased toward higher quality for income-generating assets and have extended duration on the conviction that peak yields are now behind us.

Chart 1: The Equity Earnings Outlook in the U.S. Looks Bright!

Chart 2 – The Power of the Coupon! For the First Time in Nearly A Generation Bonds Offer Meaningful Income

© 2024 WSFS Bank.

WSFS Bank d/b/a Bryn Mawr Trust Member FDIC.

Bryn Mawr Trust is a division of WSFS Bank.

Bryn Mawr Capital Management, LLC. is an SEC registered investment adviser and a subsidiary of WSFS Financial Corporation. Registration as an investment adviser does not imply a certain level of skill or training.

WSFS Financial and its affiliates, subsidiaries and vendors do not provide legal, tax or accounting advice. Please consult your legal, tax or accounting advisors to determine how this information may apply to your own situation. This communication is for informational purposes only and should not be construed as legal, tax or financial advice or a recommendation any specific product, service, security or sector. Information has been collected from sources believed to be reliable but has not been verified for accuracy.